The Hunter JO identified that there is a funding shortfall to support the evolution of the regional economy as the region experiences the downturn of its traditional industries and changing global energy markets.

To fill this investment shortfall, the Hunter JO tested a Hunter Venture Fund concept in 2022 to support the regional innovation ecosystem.

Working through a project steering group of stakeholders, Henshall Capital was engaged to undertake the work of testing a fund with the investment and innovation ecosystem, and if needed, to articulate the fund’s structure, form and design. The Henshall Capital report was finalised and found:

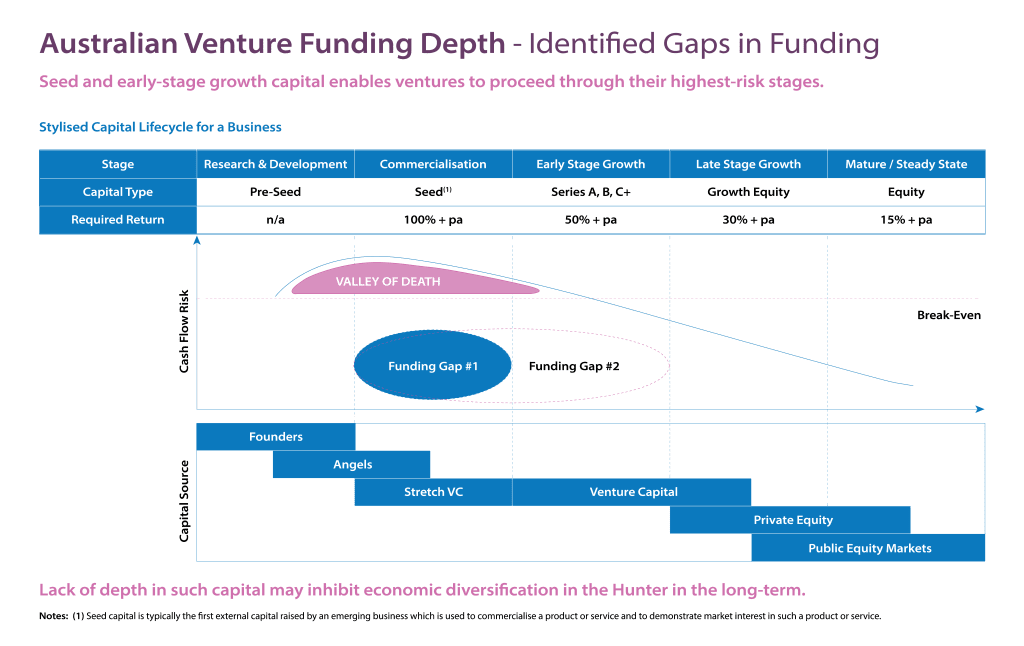

- Significant gaps in the funding pipelines in seed and early-stage start-up funding

- A commensurate shortfall of a project pipeline in the region that would attract a larger flow of funds and investment to the region

- A need for an entity that governed the regionally based fund and the parameters and institutional/legal form of each. The entity would require $1.5m per year over 5 years from all levels of government, industry and innovation partners. The fund would begin at $25m and provide an expected (not guaranteed) return of 20% over 7 years.

- Recommendations including a process for progressing the development of the fund through engagement with partners and contributors